With the two-pot retirement system signed into law, and set to be implemented on 1 September 2024, Belinda Carbutt discusses the latest retirement reform. She explains why it is important to understand the intention behind the changes so that we don’t get caught up in the noise and make the wrong (s)election.

As the national election sparked great engagement and spirited debate, another looming, impactful election awaits in your path as the new retirement fund system goes live.

The new system aims to improve retirement outcomes overall by ensuring at least two-thirds of a member’s retirement savings are preserved until retirement, while giving them some access to their retirement savings if they find themselves in financial distress. In many cases, retirement fund members withdraw all their retirement savings when given the option to, such as upon termination of employment. In other cases, members find they are not able to access their retirement savings even if they find themselves in financial hardship. The two-pot system aims to address both issues.

The new system will essentially allow you to “ink your cross” annually, giving you the option to make a partial withdrawal from your retirement funds. While this is naturally a tempting thought, it is important to understand the intent is for emergency access and should not impact the way you think about your long-term retirement savings.

While this issue does not make exciting office or dinner party chatter, nor elicit the same emotions as political debates, the impact of your election is significant.

How will it work?

The reform creates a “savings component”, a “retirement component” and a “vested component”. The vested component will house retirement benefits accumulated by the member before the implementation date of 1 September 2024. Investment growth will still be credited to this component and the existing fund rules will continue to apply.

From 1 September 2024, one-third of the member’s contributions will go into the savings component and two-thirds of total contributions into the retirement component. The savings component will be “seeded”, with an “opening balance” deducted from the vested component. This will be calculated as 10% of the vested account, capped at R30 000. Seeding is a one-off event; it will not happen annually.

Example

Siphokazi Kumalo has a pension balance of R100 000 on 31 August 2024. On 1 September 2024, this will be allocated to Siphokazi’s vested component. Siphokazi’s savings component will then be seeded with R10 000 (10% of R100 000, capped at R30 000) from her vested component. This amount will be available for withdrawal from 1 September – less tax deducted at Siphokazi’s marginal tax rate and amounts owing to the South African Revenue Service (SARS). However, it is important to note, this is not a “use it or lose it” scenario; the amount can remain invested until Siphokazi retires. The vested component will now have a balance of R90 000.

Moving forward, the savings component will receive one-third of Siphokazi’s monthly contributions; with the remainder invested in the retirement component. If Siphokazi’s retirement contribution in September 2024 is R3 000 per month, R1 000 will go to the savings component and R2 000 into the retirement component.

Siphokazi has the option of one withdrawal per tax year of at least R2 000, up to the full amount available in her savings component. It is important to note that if Siphokazi decides to withdraw, her withdrawal will be taxed at her marginal tax rate. This tax is deducted before the withdrawal is paid to Siphokazi.

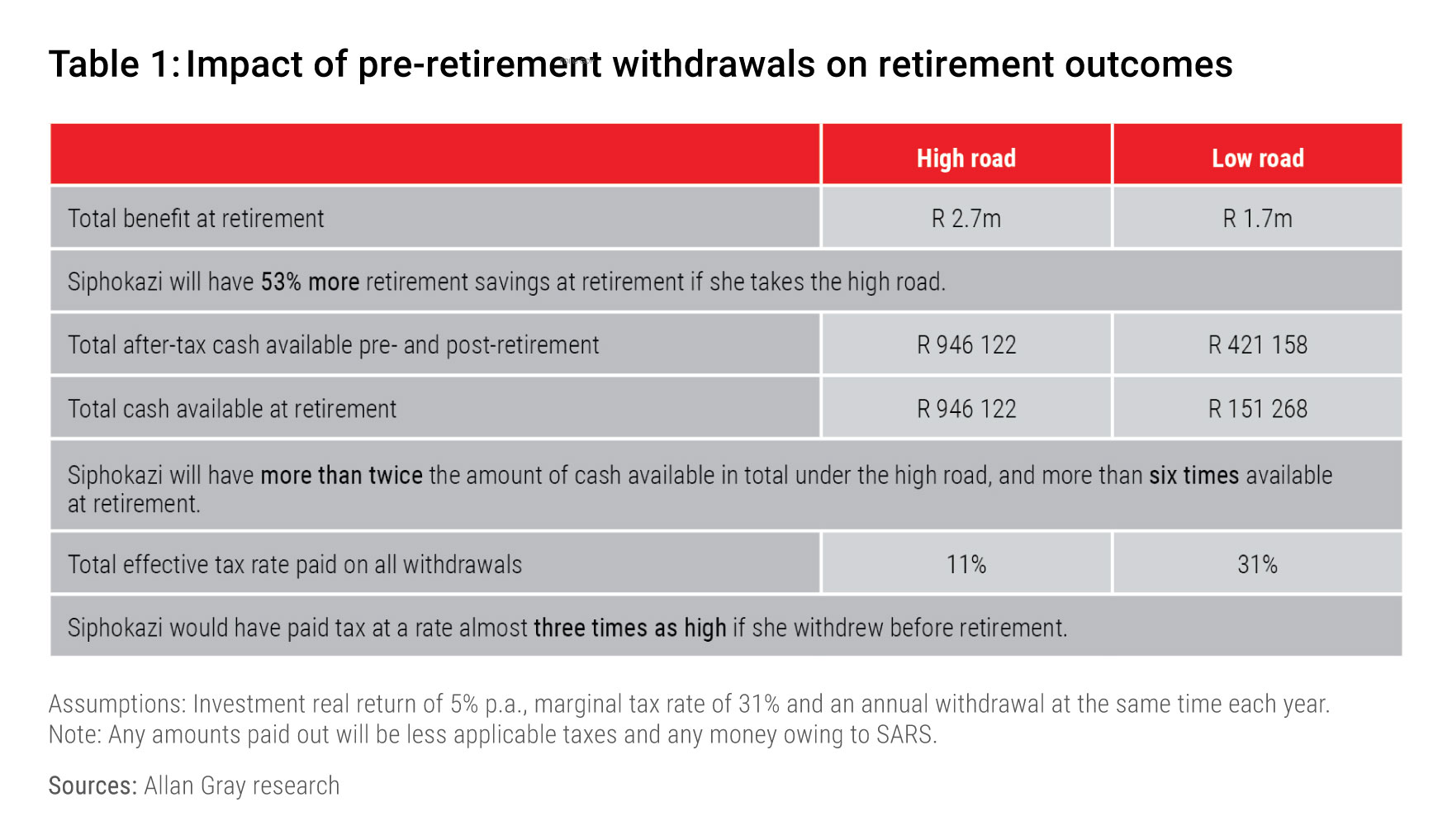

Table 1 compares two different outcomes over the next 30 years until Siphokazi retires at age 55. The high road is where Siphokazi stays focused on the long term and does not access her savings component. The low road is where she withdraws the available amount every year.

In summary, there are three important benefits of taking the high road:

- Compounding: Siphokazi has 53% more in retirement savings.

- Flexibility: Siphokazi has an option to take a cash portion at retirement. This will be six times greater than the amount in cash she would have received if she were to withdraw monthly before retirement.

- Tax savings: Siphokazi will have an effective tax rate of 11% by staying focused on the high road compared to 31% (her marginal tax rate) for cashing in her savings component in the low road scenario. This equates to paying a third less in tax.

Make the right election: Focus on the long term

The new system gives you flexibility, however, it is this flexibility that can also be the undoing of your long-term financial strategy. Remember, these reforms are intended to assist members in financial distress. Guard against being tempted to view this as a slush fund for consumption to be accessed on an annual basis; depleting the savings component equates to using up one-third of your retirement investment. Remember that your full retirement investment (the savings component, retirement component and vested component, where applicable) is intended for your retirement. Rather than relying on the savings component for emergencies, a better strategy is to build up a separate emergency fund of around three times your monthly salary that is appropriately invested and intended for immediate access during emergencies.

Not electing to withdraw, but rather choosing to stay the course for the long term, will result in better retirement outcomes as the amount in the savings component will benefit from tax-free growth. If you are considering making a withdrawal from your savings component, carefully consider your options and seek advice from a good, independent financial adviser.