As an employer providing retirement benefits to your employees, you have several obligations, which are set out in the Pension Funds Act (the Act). It is important to familiarise yourself with these to avoid running into legal action and penalties if you fail to comply. Jaya Leibowitz discusses the case of Creda Communication versus the Pension Funds Adjudicator to highlight employer responsibilities and the consequences for not following through on them.

There are two critical obligations you need to fulfill when it comes to managing your employees’ retirement fund benefits:

- You must pay over the monthly contributions to the retirement fund on behalf of your employees by no later than seven days after month end.

- You must submit “minimum information” to the retirement fund by no later than 15 days after month end. This includes, amongst other things, your business’s contact and other details, as well as employees’ personal details.

Failing to meet these obligations can lead to legal action and penalties, as was the case for Creda Communication, described below.

Case study: Creda Communication

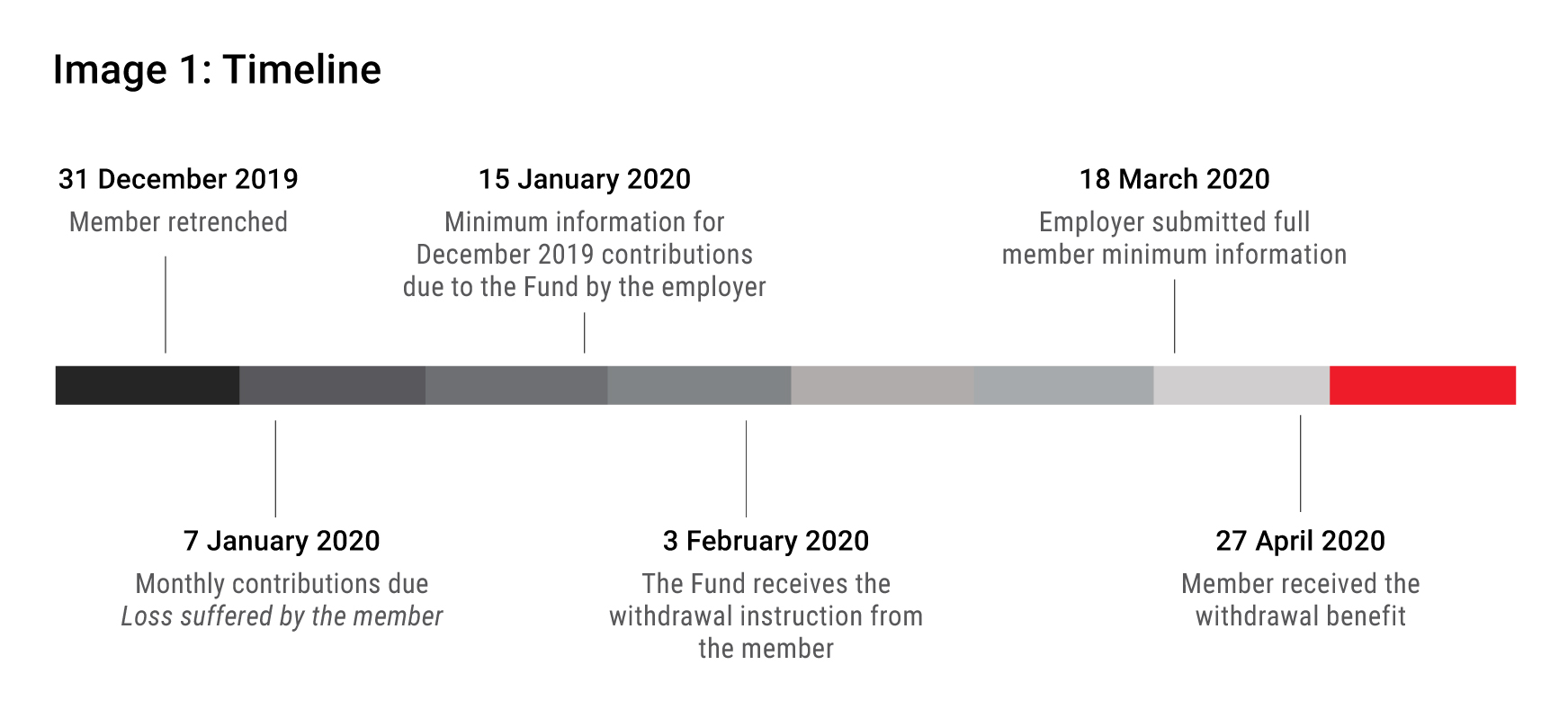

As shown on the timeline below, an employee of Creda Communication (the employer), who was a member of the GTC Group Pension Fund (the Fund), was retrenched in December 2019 and therefore was entitled to access his benefit held in the Fund. The member submitted an instruction to the Fund on 3 February 2020, asking to transfer his benefit to a preservation fund. In terms of the service-level agreement entered into between the employer, the Fund and its administrator, the Fund had 15 working days from receiving the completed instruction form to pay the member’s benefit (in this case, by 6 March 2020).

However, before the member’s instruction could be processed, the Fund required the minimum information from the employer for the month of December 2019, which remained outstanding until 18 March 2020. The employer’s failure to provide this information to the Fund resulted in the Fund delaying the transfer of the member’s benefit. This was because the Fund was unable to allocate the December contributions to the member’s records.

According to the member, the value of the withdrawal benefit decreased significantly between 7 January 2020 and 27 April 2020. The Fund maintained that the delay was due to the employer failing to provide the minimum information on time. The Fund could not process the member’s instruction without the correct membership data for the month of December 2019.

The employer acknowledged that it failed to provide the information timeously; however, it did not believe it was negligent. Unhappy with this outcome, the member submitted a complaint to the Pension Funds Adjudicator, which eventually led to the matter being considered by the Financial Services Tribunal (the Tribunal), an independent body set up in terms of the Financial Sector Regulation Act to reconsider decisions made by the Adjudicator and other bodies.

The role of the Tribunal was to assess whether the employer’s conduct caused the loss, bearing in mind that Fund members carry the risk associated with their underlying investments. In this case, the Tribunal decided that the loss was indeed due to the employer’s conduct. However, the Tribunal needed to further assess whether the loss would have occurred if the employer had fulfilled their duties and provided the minimum information to the Fund according to the legislated timelines.

The Tribunal concluded that the employer’s delay had a “direct adverse impact” on the value of the investment.

The Tribunal held the employer liable for the loss suffered from the date on which the transfer would have been made had the minimum information been provided on time (6 March 2020), until the date on which the transfer was actually made (27 April 2020).

Learnings

The Tribunal’s decision serves as a pertinent reminder of the importance of ensuring that contributions are paid and minimum information is provided to your retirement fund within the time frames set out in the Act. In addition, it is better not to delay any necessary admin when an employee has resigned and is exiting your chosen fund, as delays could result in the employer being held liable for any loss in value experienced by the member.