The South African Revenue Service (SARS) is focused on improving its systems and processes to ensure taxpayers comply with their legal obligations and file their tax returns correctly and on time. Carrie Norden, senior tax specialist, offers a step-by-step guide to help us tackle this year’s filing season.

1. Diarise the dates

The notable dates for the 2024 tax-filing season are:

- Auto-assessment notices sent by SARS: 1 to 14 July 2024

- Filing dates for individual taxpayers (non-provisional), including those who have been selected for auto-assessment: 15 July 2024 to 21 October 2024

- Filing dates for provisional taxpayers: 15 July 2024 to 20 January 2025

- Filing dates for trusts: 16 September 2024 to 20 January 2025

2. Ensure your information is up to date with SARS

Before filing season starts, it is advisable to check that your information is up to date with SARS on eFiling or the SARS MobiApp. This includes static details (your name, address, cell number, email address); your preferred communication channel (SMS or email); your income tax number; bank details; marital status and your country of tax residency. This is important to ensure that SARS can reach you (via your preferred communication channel) if you are selected for auto-assessment or pay into the correct bank account if you are due a refund.

If you have forgotten your South African income tax number, you can reach out to SARS via eFiling, the SARS MobiApp, SMS or the SARS Online Query System to confirm it.

Your marital status impacts how investment income information is prepopulated. If you are married in community of property, you are taxed on half of your own interest, dividends, rental income and capital gains, and half of your spouse’s, so their information will also appear on your return (and you need to add any missing information).

Your tax residency status impacts your tax liability. If you have ceased to be a South African tax resident during the tax year, you should inform SARS by completing the Registration, Amendments and Verification form (RAV01) on eFiling (or at a SARS branch by making an appointment) with the date on which you ceased to be a tax resident and attaching the relevant supporting documents. If you previously informed SARS that you have ceased to be a tax resident and would like to request confirmation of your status, you can submit your request to contactus@sars.gov.za. There may be tax implications when changing your country of tax residency. For more detail, please refer to Carla Rossouw’s article “Understanding your tax obligations on leaving South Africa”, available via our website.

3. Gather all the information and documents you need to file

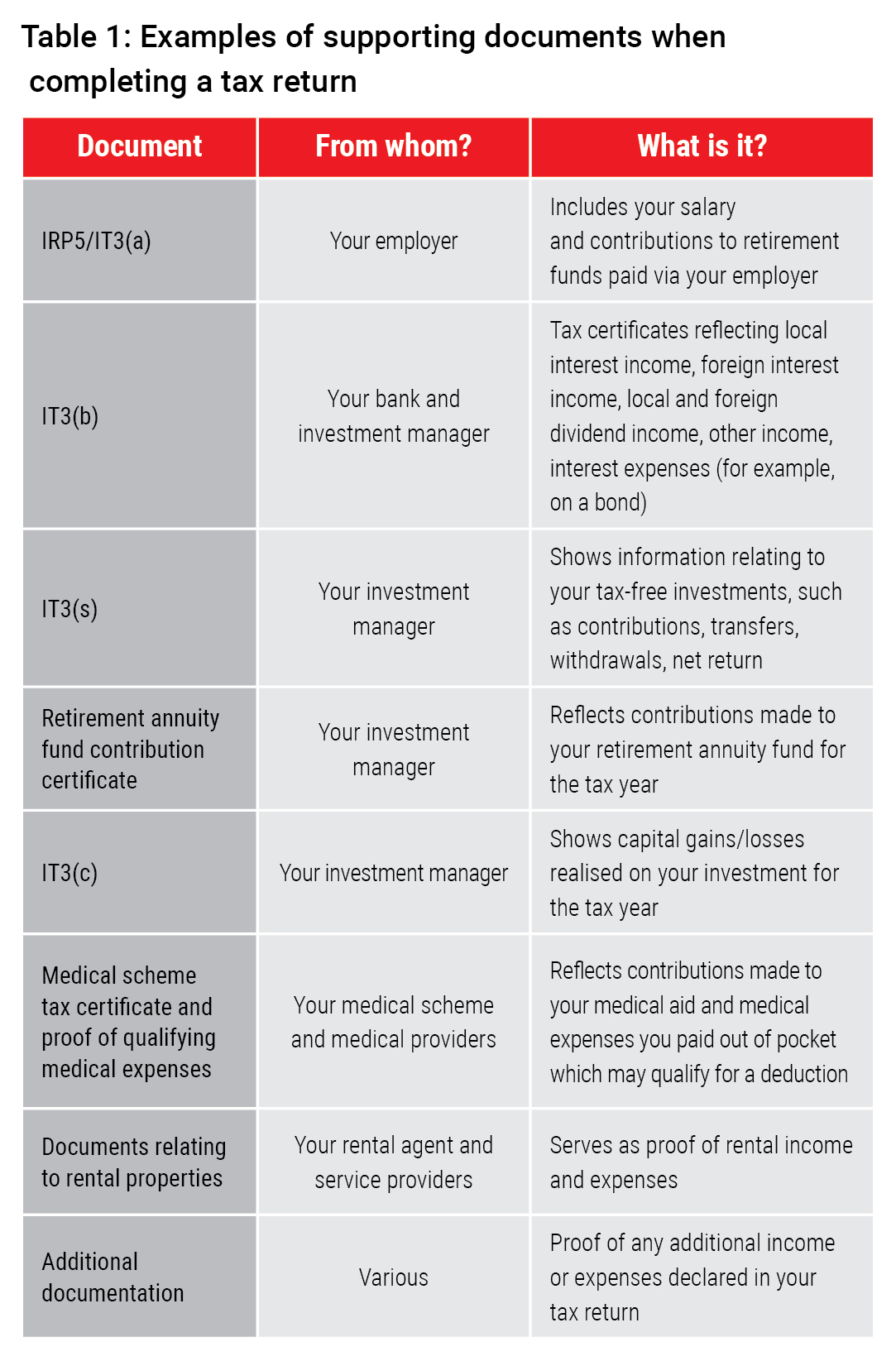

Before you get started, make sure you have all your relevant supporting documents, or request these from your service providers. Examples are listed in Table 1. Some of the information from these documents will be prepopulated on your tax return and you will need to cross check it. You may need to add some of the information manually.

You are required to keep all supporting documents for a period of five years from the date of submission of your tax return, as SARS may request these documents to verify the information declared.

4. Process to follow to file

If you are unsure if you are required to submit a return, use the intuitive tool on SARS’s website to determine whether you meet the requirements to file. The requirements for individuals to file are also summarised in the checklist at the end of this article.

If you were auto-assessed and are happy with the assessment result

For certain pre-selected taxpayers (whose tax affairs are not too complicated), SARS uses third-party data from employers, financial institutions, medical schemes, retirement fund administrators, registered insurers and other providers to perform a tax calculation and issue a Notice of Assessment (ITA34) for the tax year.

If SARS notifies you via SMS or email that you have been selected for auto-assessment and an ITA34 for the 2024 tax year has been issued to you, you need to log into eFiling or the SARS MobiApp to view the assessment. The ITA34 document will display the data SARS used to calculate your assessment.

This year, SARS is increasing the number of taxpayers who are auto-assessed. If you are unsure whether you have been selected for auto-assessment, you can check via the SARS Online Query System.

If you agree with the auto-assessment result, you do not need to do anything. If a refund is due to you, it should be paid within 72 hours, provided the banking details SARS has on record for you are correct. If you owe SARS money, you need to make payment via eFiling or the SARS MobiApp before the payment due date (displayed on the ITA34) to avoid interest or penalties being charged. You can also pay SARS at your bank branch or via EFT.

If you wish to amend or add any information to your auto-assessment, you will need to log into eFiling or the SARS MobiApp and file a tax return in the usual way. You have from the date you receive the auto-assessment notice from SARS until the end of the 2024 filing season to do so.

If you need to submit a return

Having completed steps 2 and 3 above, you can log into eFiling or the SARS MobiApp and get started on your return. The process is outlined below:

a) Build your return: Once you have opened your return, your filing process begins with a “form wizard” – questions which you will need to answer on the first page to customise the additional fields which display. You can consult the SARS Comprehensive Guide to the ITR12 Income Tax Return for Individuals, available on their website, for assistance. Some of the information will be populated automatically once your return generates; you will need to manually add other information.

b) Check against your supporting documents: Once your return is built, compare the prepopulated third-party information against the information on your supporting documents. Third-party data that has been prepopulated in your return cannot be edited. If any of the prepopulated data is incorrect, you will need to ask the third party that provided the data to correct it by resubmitting the amended data to SARS.

c) Add outstanding information: You will need to manually add information from your supporting documents that is not automatically included. Examples include capital gains or losses incurred from the sale of assets (which can be found on your IT3(c) tax certificates), rental income and related expenses, and excess medical expenses which were not covered by your medical aid.

d) Calculate your outcome: Use the tax calculator button to get an estimate of your assessment result based on the information you have included. If it feels off, check carefully that all the information you have inputted is correct.

e) Submit your return: Once you are comfortable with the result, you can go ahead and submit.

f) Check your outcome: An ITA34 document will be generated with your results for the tax year, which you should save for your records. You can also check your tax return status on the SARS Tax Return Status Dashboard (part of the SARS Online Query System), which allows you to check the progress of your income tax return.

Late submissions

SARS charges non-compliance penalties for each month that your return is outstanding. These penalties are charged where one or more tax return(s) are outstanding from the 2007 tax year onwards. SARS may collect these penalties from appointed third parties, such as your employer, investment manager or directly from your bank account if you do not submit your returns or pay your tax liability on time.

Under certain conditions, you can request an extension to file your tax return within 21 business days after 21 October 2024. However, the extension does not waive late-filing penalties, which means that any return filed after 21 October 2024, regardless of the circumstances, will be penalised.

If you need further assistance, a full list of help channels is available on the SARS website, or you should chat to your independent financial adviser or tax practitioner.

Checklist to assess if you need to file

If any of the following applies to you, you are required to file a tax return for the 2024 tax year:

1. You are a South African tax resident who:

- Earned a taxable income above the tax thresholds (the amounts above which tax is payable according to the individual tax tables, based on your age on 29 February 2024); and/or:

- Earned capital gains or losses exceeding R40 000

- Carried on a business or trade (in or outside of South Africa)

- Earned a foreign salary for work done as an employee outside of South Africa

- Owned foreign currency or assets of more than R250 000 at any time during the tax year

- Earned income or capital gains from foreign currency or assets outside of South Africa

2. You are a non-South African tax resident who:

- Sold assets which are subject to capital gains tax in South Africa (for example, you sold South African fixed property or a right to fixed property, assets effectively connected to a South African permanent establishment, or shares in a company or a vested interest in a trust, if at least 80% of the value of the interest is in South African fixed property, and you hold at least 20% of the shares or rights of the company or trust).

- Received interest income from a South African source, and you were either physically present in South Africa for longer than 183 days in total during the 12 months before the interest was earned, or the debt from which the interest was earned relates to a permanent establishment in South Africa.

- Carried on a business in South Africa.

Not everyone is required to submit a tax return to SARS for the 2024 tax year. You do not need to file if you:

1. Were selected by SARS for auto-assessment, and you are comfortable that all your prepopulated information reflects correctly in SARS’s records to give effect to the auto-assessment.

2. You have no deductions to claim and only earned a salary or similar remuneration from one employer of R500 000 or less for the tax year, provided your employer correctly deducted employees’ tax for the period and declared this to SARS. For example, if you also earned rental income or had two employers during the tax year (if you changed jobs), you will need to file a return.

3. Only earned the following sources of income for the tax year:

- Interest income from a South African source (such as unit trusts) below the taxable thresholds (R23 800 for those under 65 years, and R34 500 for those 65 years and older on 29 February 2024)

- Amounts from a tax-free investment

- Lump sums from a South African retirement fund, where tax has been withheld based on a tax directive issued by SARS

- Dividends that are exempt from normal tax (if you were not tax resident in South Africa throughout the 2024 tax year)