In his annual President’s letter, Adam R. Karr, from our offshore partner, Orbis, pays tribute to Gillian Gray, who passed away in December 2024. He also reviews the performance of the Orbis portfolios over the past 12 months, reflects on the investment lessons from the year and discusses why adaptability is essential for future success.

It’s hard to believe three years have passed since my first letter as President of Orbis. Time, like markets, compounds – often in surprising ways. This year delivered solid returns, but also a humbling reminder of the market’s unpredictability. Every year teaches us lessons, and 2024 was no exception.

Our purpose is clear and enduring: to deliver results that transform lives over time.

In times like these, adaptability feels more essential than ever.

Amidst the change, some things remain constant. Our purpose is clear and enduring: to deliver results that transform lives over time.

Last month, I travelled to Bermuda to honour the life of Gillian Gray, wife of our founder, Allan Gray. It was a moment to reflect on the profound role Gill and Allan played in transforming so many lives – not just through financial wealth, but through wealth of opportunity and purpose.

Their legacy serves as a powerful reminder of why we do what we do – and the responsibility we carry to make a difference.

Looking back: Performance

In 2024, our clients’ capital appreciated 10.7% on a firm asset-weighted basis. On a relative basis, our Strategies underperformed their respective benchmarks by 2.2% net of fees, also on an asset-weighted basis.

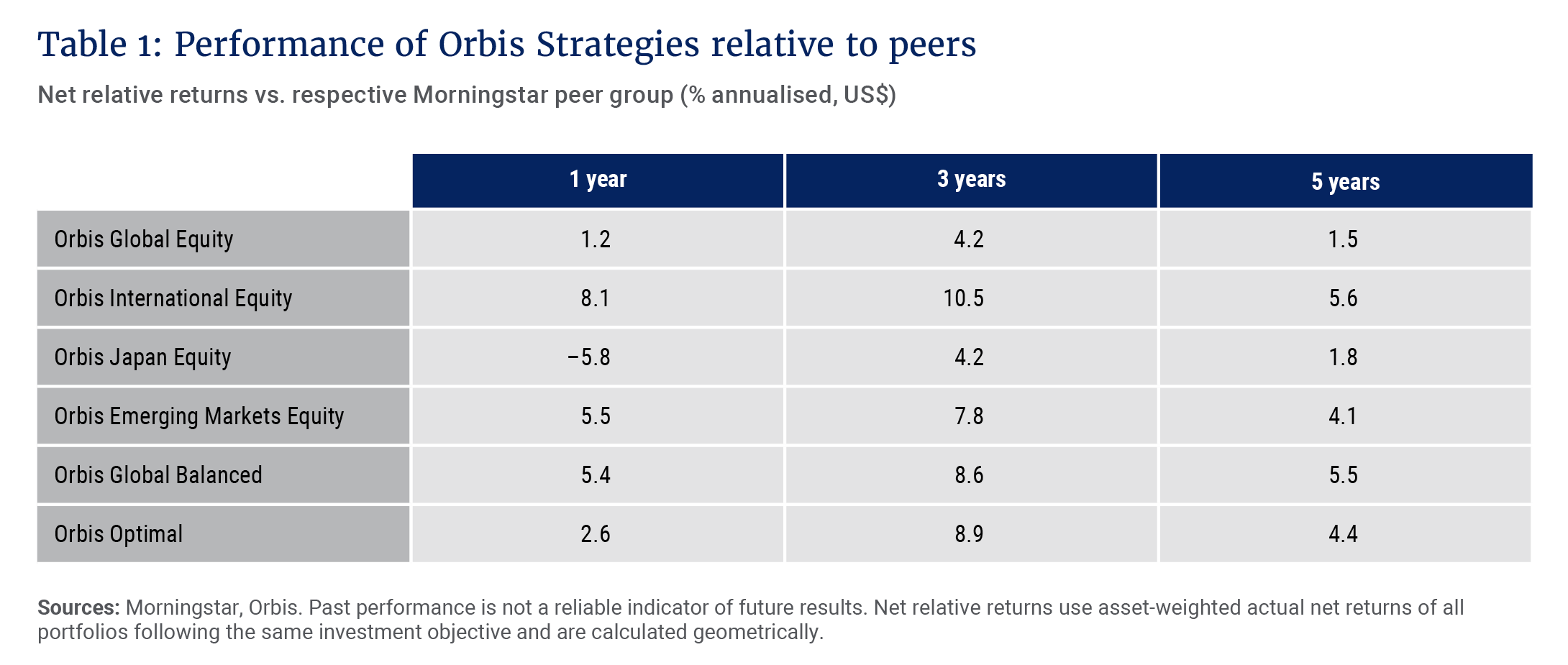

One year is just a chapter. What matters most is our ability to compound results over time. Over the past three and five years, our clients’ capital appreciated at annualised rates of 6.7% and 8.2% respectively on a firm asset-weighted basis. During these periods, we also achieved positive annualised net relative returns of 2.7% and 0.2%, with all strategies outperforming their peer group averages, as shown in Table 1.

A few key observations from the past year:

- First, two of our equity strategies delivered world-class performance: our International Strategy achieved net relative returns of 7.9%, and our Emerging Markets Strategy produced net relative returns of 3.9%. Also impressive, our Global Balanced Strategy achieved a return of 12.1% and net relative returns of 2.6%.

- Second, while our Global Equity Strategy delivered a net return of 12.5%, it lagged the MSCI All Country World Index (ACWI) by 4.2%. This result stings, and we own it. We made well-reasoned decisions that did not yield the alpha that we aim to deliver in this calendar period. The outcome was not entirely surprising, however, given our underweight to a surging US market (S&P 500 up 25%) and limited exposure to the narrow set of high-growth stocks driving much of the index’s gains (NASDAQ up 30%).

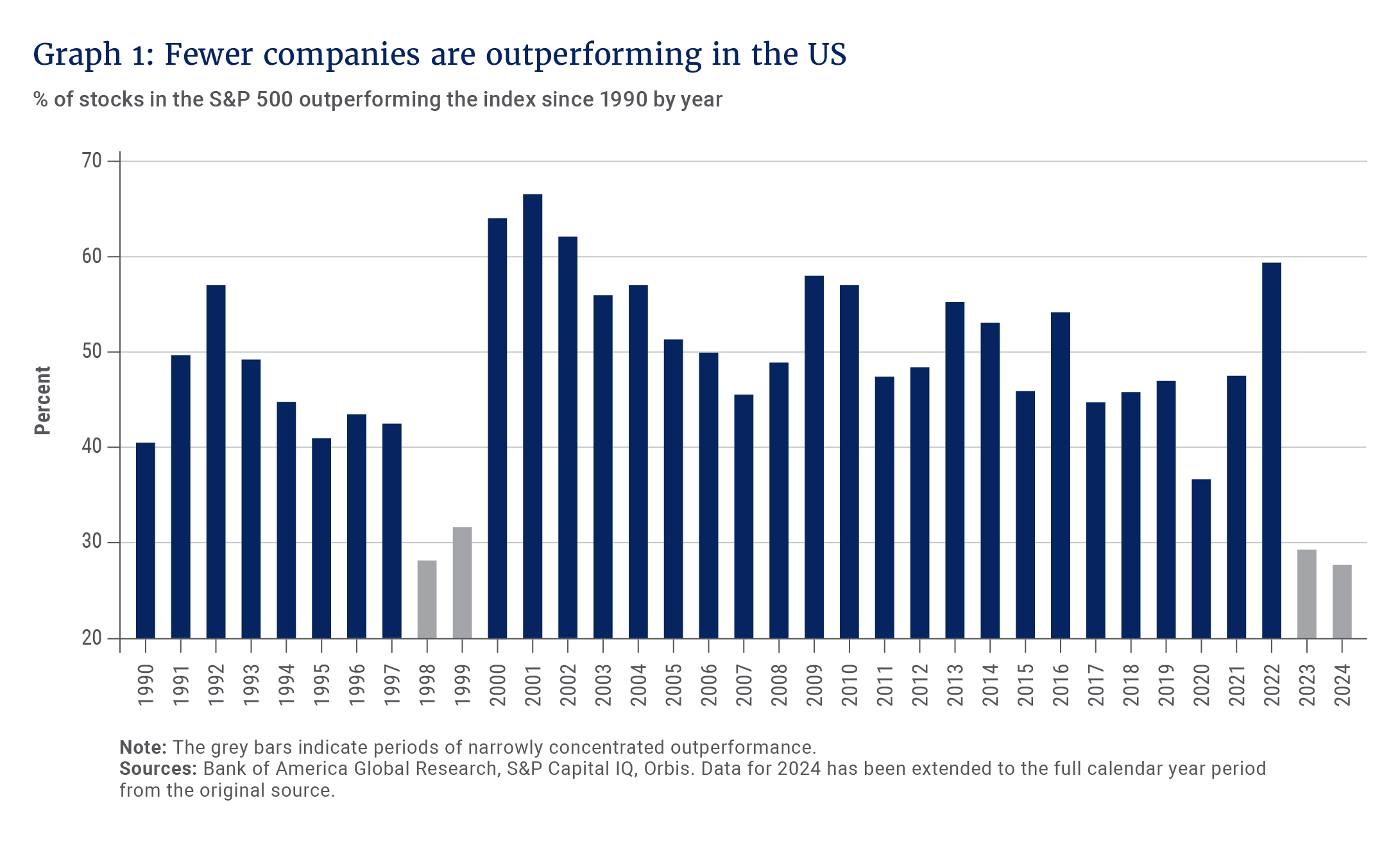

These results did not come easily. Reflecting on the year, the real story lies in how we achieved them – through strong idiosyncratic stock selection, a testament to our research engine. In a year where stellar market gains were concentrated in a handful of high-growth stocks, opportunities for outperformance were scarce, as reflected in Graph 1. Yet, Orbis Global delivered solid absolute returns, demonstrating the power of our research-driven approach to uncover opportunities beyond the market’s crowded consensus.

Periods of such narrowly concentrated outperformance – like we saw in 1998 and 1999 – often set the stage for active managers to sharply excel. However, these cycles can persist longer than expected, testing patience and conviction. I like to say, “it works because it hurts”. This discomfort isn’t a flaw – it is the source of opportunity. It is precisely this environment that creates the potential for meaningful alpha, and it is why we are excited about what lies ahead.

Looking back: Markets

Global markets delivered surprisingly strong returns in 2024, fuelled by optimism around AI, shifts in monetary policy, resilient earnings and, in some corners, the promise of Trump and DOGE.

But beneath the surface, it wasn’t one market – it was two. On one side, Nvidia and a handful of tech titans dominated headlines and benchmarks. On the other, a vast “Missed Middle” of overlooked, undervalued companies played in the shadows. The spotlight on the tech stars has been so blinding, it is easy to miss the orchestra in the background.

The magnitude and duration of this dominance were extraordinary – beyond what we anticipated. It’s a sobering reminder that, despite a thoughtful process and rigorous analysis, markets still surprise us.

Today’s market concentration echoes past cycles like the Nifty Fifty and Dot-Com bubble, both of which ended painfully for those who failed to diversify. At the same time, we are witnessing the widest valuation gap in history between the average US-listed stock and the rest of the world. Risks – both obvious and hidden – are mounting.

For active managers, this isn’t a warning sign; it’s an opportunity.

The Magnificent Seven may have carried the market on their shoulders, but even the strongest shoulders tire, and crowds eventually move on. History shows that such market dynamics often create significant dislocations – opportunities for those who think independently, uncover overlooked value, and remain disciplined in their focus on fundamentals.

This is where we can thrive.

The value of Orbis in your portfolio

Whether it’s deregulation under Trump, shifting geopolitical alliances, or technological leaps, these moments don’t just reshuffle the deck – they create winners and losers. Trump’s agenda is clear – he seems set to redefine LFG as “Less Federal Government”, signalling potential waves of deregulation and a tilt toward nationalism and mercantilism. It is less clear what it means for markets.

Our job isn’t to predict every twist perfectly – it’s to understand the terrain, adapt, and invest wisely.

... we balance across the global opportunity set, guided by fundamentals.

Investor portfolios today are more concentrated than ever, especially in US stocks. Many investors – intentionally or not – are making an outsized bet on continued US dominance, a narrative that’s reflected in high valuations. Trump wants the US to win, but will US stocks continue to deliver stellar double-digit returns when much of their future success may already be priced in?

The good news: perfect predictions are not required.

In a storm, safety often lies in the overlooked lifeboat, not the crowded ship. At Orbis, we don’t overcommit to any single geography or narrative. Instead, we balance across the global opportunity set, guided by fundamentals. This deliberate approach is because the market has a way of reminding us to stay humble, especially at extremes.

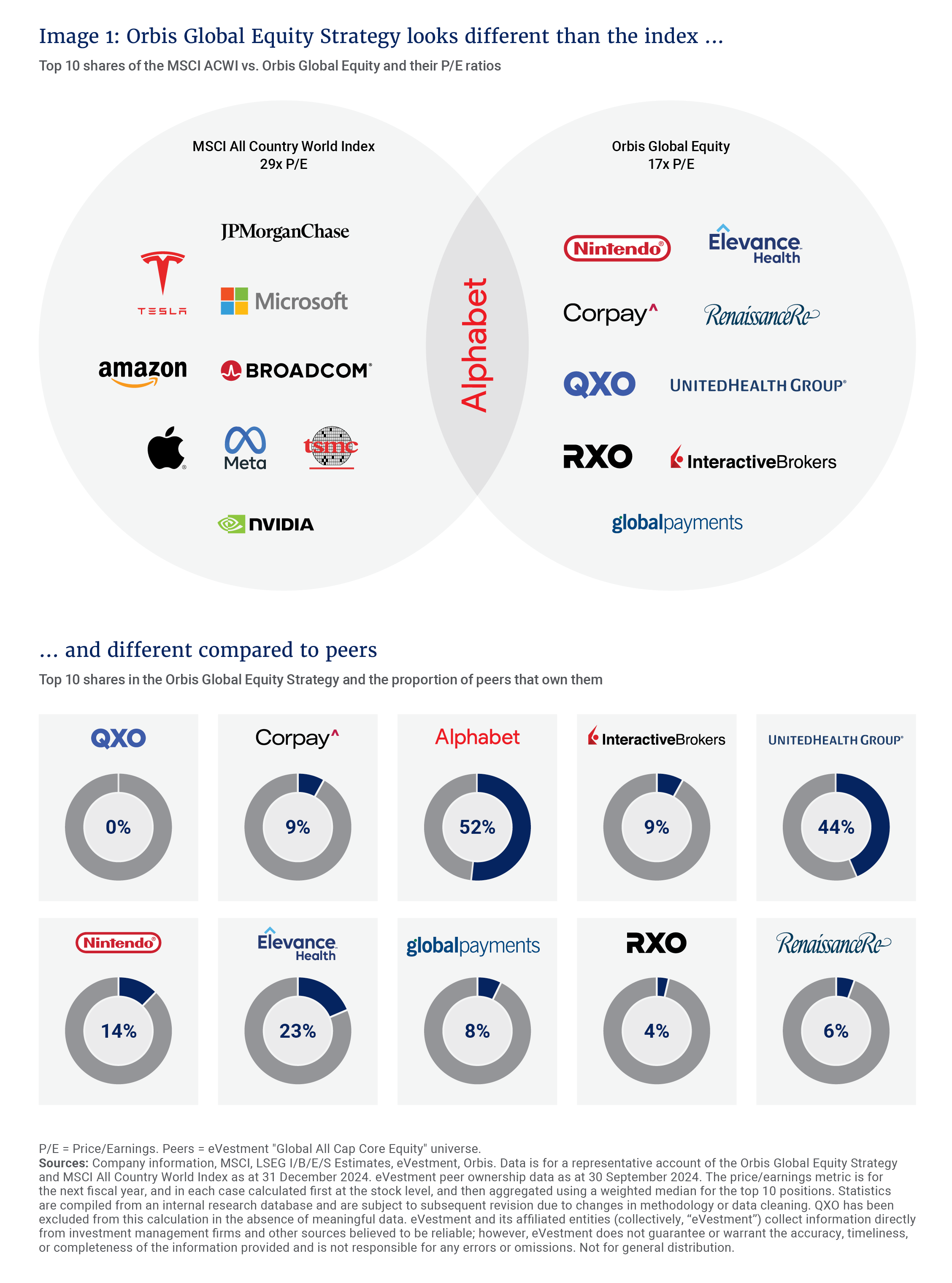

We construct our portfolios by focusing on the most significant discounts to intrinsic value. This approach often leads to a portfolio that looks markedly different. As shown in Image 1, we share only one top 10 holding – Alphabet – with the benchmark and have little overlap with our peers. This isn’t for the sake of being different, rather a commitment to our philosophy and the pursuit of compelling risk-adjusted returns.

In a world increasingly defined by stark extremes – growth vs. value, US vs. the rest of the world, risk vs. safety – we aim to provide a balanced alternative. That is part of the value Orbis brings to your portfolio – we are not just another voice in the crowd.

Patience and adaptability: Lessons from Japan

In 2024, I visited Japan for the first time, and it left a profound impression. Japan exemplifies an extraordinary dedication to quality and craftsmanship, where even the smallest details are obsessed over – often when no one’s watching.

On a recent episode of The Knowledge Project Podcast, I shared how my grandfather instilled in me a similar mindset through his tireless work ethic and commitment to excellence. His devotion to craftsmanship came to mind as I reflected on Japan’s shinise – businesses that have endured for generations. Remarkably, over 50 000 companies have thrived for more than a century. The oldest, Kongo Gumi, dates back to 578 AD, when it was entrusted with building Japan’s first Buddhist temple.

That’s long-term thinking!

Yet, what struck me most was their deep appreciation for the present. Japanese culture balances the long game with an appreciation for the present moment – captured beautifully in the expression Ichigo Ichie (one time, one meeting). Japan’s shinise businesses offer a powerful metaphor for our approach – balancing long-term resilience with short-term adaptability.

… we sweat the details – because building something lasting requires patience and precision.

At Orbis, we view long-term thinking and short-term action not as trade-offs, but as complementary forces. Our founder personified this mindset, and it remains today. We hold stocks for years but scrutinise our decisions daily. We act with conviction and velocity when opportunities arise, and we sweat the details – because building something lasting requires patience and precision.

The challenge is recognising when to hold firm and when to adapt. Elite rowers understand this intuitively: grip too tight, and you’ll flip the boat; grip too loose, and you’ll lose control. Success isn’t about strength – it’s about knowing when to adapt at the right moment.

At Orbis, adaptability is a priority for us.

Three years in: Behind the scenes with process and people

As I reflect on my third year as President, it feels like an appropriate moment to pause, take stock, and share our progress. This period has been defined by focused effort, deliberate change and steady progress – that is an ongoing commitment to strengthen our foundations.

At Orbis, our flywheel is not just a metaphor; it’s an engine that builds momentum through small, consistent inputs compounding over time. Our flywheel is powered by the independent-minded people we empower, the disciplined and objective processes we employ, and the culture of alignment we foster across everything we do. These elements don’t stand alone – they work together, reinforcing one another in a self-sustaining manner.

In this section, I want to take you behind the scenes to show how our investment process has evolved and how our people remain the driving force behind everything we do.

Our investment process

While performance charts capture the “bottom line”, they rarely tell the full story. Behind every number lies years of focused investment and effort.

Over the past three years, we’ve made several targeted enhancements to our process:

- Portfolio construction: Simplified our Global Strategy’s structure to empower our key decision-makers.

- Global research team: Reorganised to deepen sector expertise and generate more specialised insights.

- Decision analytics: Embedded advanced analytics tools to identify and mitigate behavioural biases.

- Quant and data insights: Appointed Gideon Smith as Head of Quant to integrate data-driven insights more effectively.

- Responsible investing: Raised the bar with enhanced tools, processes, and transparency to ensure responsible investing remains central to our approach.

These changes aren’t flashy, but they are impactful, and they have strengthened our flywheel.

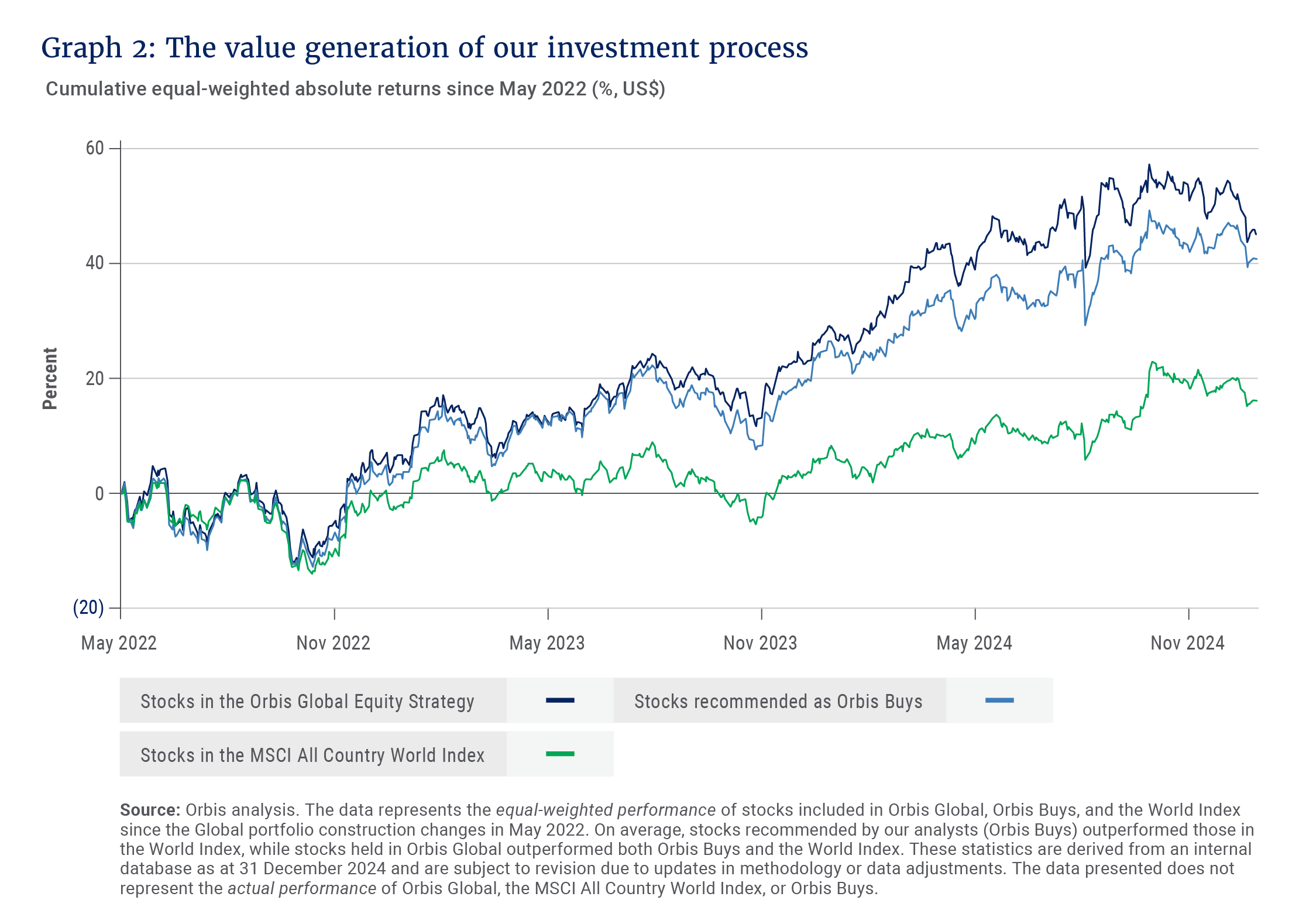

A clear illustration of this can be seen in how the stocks in the Orbis Global portfolio perform compared to those in both its benchmark and the pool of “Orbis Buys” generated by our research engine. The equal-weighted data shown in Graph 2 tells a compelling story: Our analysts’ recommendations consistently outperform the benchmark stocks, and our decision-makers in the Global Strategy added further value through thoughtful selection.

It is exactly what we aim for and reflects a rigorous process executed with discipline.

Our people: The engine behind the results

While investment performance often takes centre stage, our people bring it to life. At the heart of everything is our people. This year, a new generation of leaders stepped up – many of them unsung heroes – thinking independently, embracing responsibility and delivering results. From processing thousands of investment recommendations to our client team building deeper, more meaningful partnerships, every corner of Orbis is alive with purpose and progress.

Under Darren Johnston’s leadership, the past three years have seen meaningful enhancements:

- Key appointments: Welcomed Daniel Belshaw as our first Chief Technology Officer and appointed Jason Ciccolallo as Global Head of Clients, enhancing our focus on technology and client engagement.

- Operational improvements: Conducted a comprehensive review of our capabilities, reaffirmed our strengths and highlighted key areas for ongoing improvement.

- Simplification: Continued to streamline our operational and regulatory footprint and remove unnecessary complexity to sharpen our agility.

We have also prioritised telling our story more effectively. A standout example is our video Unsung Heroes of the Energy System, which recently earned a Citywire award for best storytelling in any medium. It's a great example of how we aim to bring clarity and transparency to the decisions we make on your behalf.

These initiatives reflect our ongoing commitment to serving clients better every year.

Gratitude and momentum

Looking back on 2024, Darren and I are filled with gratitude: for our talented colleagues, for the trust you place in us, and for the opportunity to build something enduring. I’m also grateful for the moments of challenge and growth this year brought me personally.

The work isn’t finished, it never is. But the momentum is real, and I’m excited about what’s ahead.

Conclusion

As always, I want to close by reaffirming my commitment to you:

Our firm’s success begins and ends with delivering best-in-class investment performance. As it was on day one, I am certain that what we aspire to achieve will not be easy. But how we show up is in our control and we are determined to deliver. Here is my commitment to you: relentless focus; transparent and direct engagement; entrusting others; a culture of inclusion; the courage to be different; an appetite for feedback; and a willingness to change what isn’t working. You can expect me to do my part and to ensure that others do theirs. And we will keep showing up every day for you.

We have much work ahead, and this is just the beginning.

Explore more insights from our Q4 2024 Quarterly Commentary:

- 2024 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Paying tribute to Gillian Gray by Craig Bodenstab

- Diamonds in the rough: A look at luxury by Jithen Pillay

- Where investors fear to fish by Rory Kutisker-Jacobson

- In safe hands with the Allan Gray Balanced Fund by Nick Curtin

- How to maximise tax benefits in a two-pot era by Carla Rossouw and Lee Kotze

- How to keep the lid on lifestyle creep by Twanji Kalula

To view our latest Quarterly Commentary or browse previous editions, click here.