We have recently introduced two new funds to our offering – the Allan Gray Interest Fund and Allan Gray Income Fund. The addition of these funds broadens our range, providing you with a more comprehensive selection of lower-risk investment options. Vuyo Mroxiso describes the new funds, how they fit into our range and how they may meet your needs.

At Allan Gray, we aim to keep our fund range focused. We only introduce new offerings after careful consideration, and when we believe the additions will better help you meet your goals and objectives. We believe our two new funds have an essential role to play in an investor’s toolkit and are good options for risk-averse investors to consider. They are explained in more detail below.

Introducing the Allan Gray Interest Fund

What is the goal of our Interest Fund?

We have added the Allan Gray Interest Fund (Interest Fund) to our core fund range. This fund’s goal is to generate higher returns than bank deposits and traditional money market funds while maintaining capital stability and low volatility.

The Interest Fund's benchmark is the Alexander Forbes Short-term Fixed Interest (STeFI) Composite Index. The Interest Fund's returns are likely to be less volatile than those of traditional income and bond funds, but more volatile than those of money market funds.

Who is the Interest Fund suitable for?

Our Interest Fund is suitable for you if:

- You are risk-averse and want to protect your capital

- You require monthly income distributions

- You want to invest for only six months to one year

What do we invest in to achieve the Interest Fund’s goal?

To achieve the Interest Fund’s goal, we invest in a mix of South African interest-bearing securities issued by the government, parastatals, corporates and banks. We take a cautious approach to credit risk (the risk that a borrower will fail to meet its repayment obligations), liquidity risk (the risk that an asset cannot be bought or sold quickly enough) and duration risk (the risk that changes in interest rates will either increase or decrease the market value of a debt instrument). We choose assets for the Interest Fund based on our analysis of and outlook on interest rates, inflation and the resulting South African Reserve Bank (SARB) policy response.

What is the management fee of the Interest Fund?

The Interest Fund charges a fixed management fee of 0.65% per year. This includes our administration fees, which are currently set at 0.20% per year (excluding VAT).

Introducing the Allan Gray Income Fund

What is the goal of our Income Fund?

We have added the Allan Gray Income Fund (Income Fund) to our selection of specialist funds. This fund’s goal is to generate income and produce higher returns than traditional money market funds while preserving capital and minimising the risk of loss over any one- to two-year period. The Income Fund’s benchmark is the Alexander Forbes Short-term Fixed Interest (STeFI) Composite Index. The Income Fund’s returns are likely to be less volatile than those of a traditional bond fund.

Who is the Income Fund suitable for?

Our Income Fund is suitable for you if:

- You are risk-averse and want to protect your capital

- You want a unit trust that provides you with an income

- You are investing for at least one to two years

What do we invest in to achieve the Income Fund’s goal?

To achieve the Income Fund’s goal, we primarily invest in South African interest-bearing securities, with the portfolio having limited exposure to offshore interest-bearing securities. We take a conservative approach to credit risk, liquidity risk and duration risk, and avoid excessively structured and opaque instruments.

We believe our two new funds have an essential role to play in an investor’s toolkit …

While the Income Fund can have limited exposure to equities and property, we expect this to occur infrequently and to typically coincide with unusual or extreme points in the valuation cycle. We choose assets for the Income Fund based on our analysis of and outlook on interest rates, inflation and the resulting SARB policy response.

What is the management fee of the Income Fund?

The Income Fund charges a fixed management fee of 0.75% per year. This includes our administration fees, which are currently set at 0.20% per year (excluding VAT).

Other potential uses of the new funds

Some investors choose to adopt a “bucketing” approach in managing their retirement assets, i.e. they use different portions of their portfolios to fulfil different objectives. If you are seeking income-generating funds for the short- to medium-term liquidity component of your retirement income portfolio, these new funds may be useful to you. They could also be considered for other short-term needs, such as an emergency fund.

As always, it is advisable to assess whether the funds will meet your needs with the help of an independent financial adviser.

Where do the new funds fit into our range?

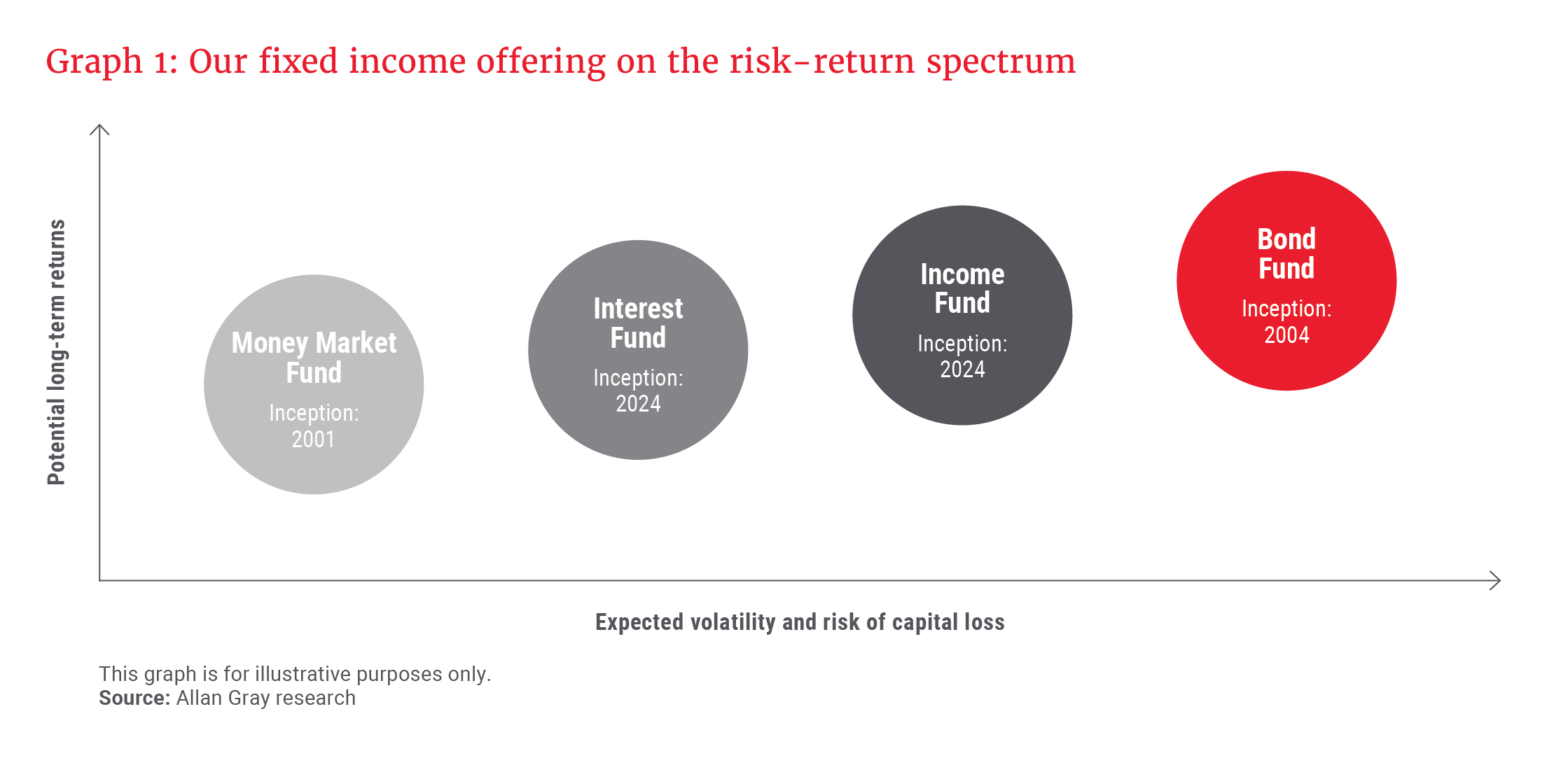

Graph 1 shows where these funds fit into our fixed income offering. The Allan Gray Money Market Fund (Money Market Fund) is our lowest-risk fund, providing exposure to short-dated and highly liquid instruments.

We expect the Interest Fund to generate returns that are higher than those of our Money Market Fund, and only slightly more volatile. This is because our Interest Fund typically does not take on materially greater credit risk than our Money Market Fund, but rather lends to similar or the same entities for slightly longer periods (i.e. it has less restrictive maturity and duration limits) in pursuit of enhanced returns. For clients with an investment horizon of up to one year, we therefore believe the Interest Fund is a better alternative than traditional money market funds.

While the Interest Fund has a more flexible mandate than the Money Market Fund, the Income Fund, in turn, has more flexibility than the Interest Fund: The Income Fund has no prescribed maturity or duration limits and can invest in offshore interest-bearing securities when these assets offer a more appropriate balance of risk and reward.

We manage the Income Fund with a relatively lower risk appetite than traditional bond funds. As such, we typically expect the Income Fund to sit higher up on the risk-return spectrum than the Interest Fund, but lower than the Bond Fund.

Our investment approach and track record

We have a 46-year history of managing fixed income mandates and currently manage over R147bn in fixed income assets across our retail and institutional portfolios, running multiple specialist fixed income strategies. The Interest and Income funds have slotted seamlessly into our well-established investment process, which leverages the skills and experience of our entire Investment team. We believe that viewing markets holistically provides valuable insights across asset classes and gives us a strategic analytical advantage in this space.

While past performance is not a guarantee of future performance, we believe we are well positioned to deliver long-term returns without taking undue risks.

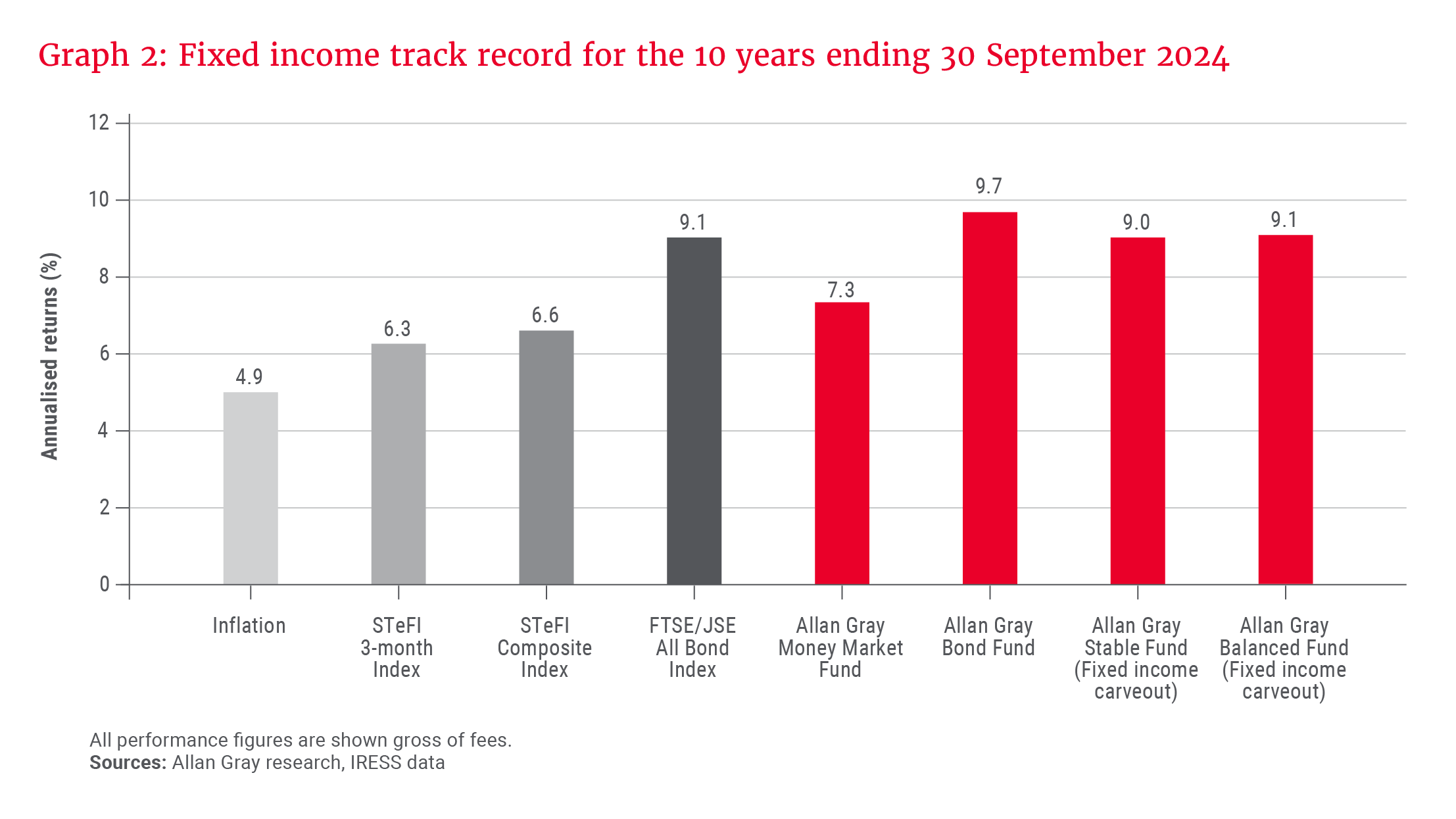

The Interest and Income funds were first seeded on 1 May 2024, therefore their track records are not yet available. However, as illustrated by Graph 2, over the last 10 years, our Money Market Fund, Bond Fund, and the portion of our Stable and Balanced funds that is invested in fixed income (the fixed income carveouts) have delivered real returns for clients – well in excess of inflation and the STeFI Composite Index returns. While past performance is not a guarantee of future performance, we believe we are well positioned to deliver long-term returns without taking undue risks.

How are the funds positioned given the uncertain environment?

As with all Allan Gray funds, the positioning of the Interest and Income funds is mainly driven by our bottom-up approach – i.e. we assess each asset based on its specific characteristics – drawing on our fundamental research process and capital allocation capabilities.

The Interest and Income funds were seeded at a time of heightened political uncertainty and increased market volatility. In early June 2024, the local debt markets witnessed a sell-off after the African National Congress lost its outright majority for the first time since 1994. During this period, there were good opportunities for the Interest and Income funds to lock in five-year fixed-rate cash exposures at a 10% yield, as well as for the Income Fund to invest in structured fixed-rate instruments yielding 12%.

Mid-June marked a pivotal moment for the country as the newly established government of national unity convened for its inaugural parliamentary session and Cyril Ramaphosa was re-elected as president. The rand, the FTSE/JSE All Share Index and the bond market all experienced substantial gains, signalling investor confidence in the potential for economic reforms and stability.

During its September Monetary Policy Committee (MPC) meeting, the SARB kicked off its rate-cutting cycle, with MPC members agreeing a less restrictive stance to be consistent with sustainably lower inflation over the medium term and lowering the repo rate by 25 basis points to 8.00%. However, the SARB outlined a case for caution, citing risks to inflation via a potentially adverse external environment, including the potential for offshore trade tariffs, renewed supply chain disruptions, geopolitical tensions, and elevated policy uncertainty globally.

While the future remains uncertain, we aim to construct portfolios that can perform well across a range of possible scenarios. We believe the portfolios currently hold assets that can provide above-cash returns and protect income in a high-inflation environment, particularly if interest rates remain higher than the prevailing inflation rate, as has been the case in South Africa over long periods.

Over the long term, the mix of assets that will best fulfil each fund’s mandate is expected to evolve alongside available opportunities. What will remain constant, however, is our focus on finding securities that offer an attractive real yield, issued by creditworthy entities with a low risk of default, and from there building fixed income portfolios that balance capital protection, risk of loss and income generation.